Image source: Freepik

Landlordship, while rewarding, is no easy feat, when you add up all the money coming in and going out, it can get tricky. And with the HMRC keeping a close eye with the Let Property Campaign, you don’t want to make mistakes.

Recent reports highlight an alarming 83% increase in cases involving buy-to-let landlords and undeclared income during the 2022/23 tax year.

So, how do you make sure everything adds up right and stay out of trouble? We discuss this and more in this article.

What is the Let Property Campaign?

HMRC’s Let Property Campaign, initiated in September 2013, was conceived track rental properties and recover undeclared rental income. Since its launch, approximately 1.5 million landlords were discovered to be sidestepping the declaration of a monumental £500m in rental income annually.

While it was meant to last 18 months, the whopping figures recovered have kept it active till today. The past year alone flagged 5,429 landlords for non-disclosure in their tax returns, leading to HMRC recouping £33m, averaging a significant £6,078 per landlord.

Under this campaign, HMRC is empowered to:

- Retrieve up to 20 years of undisclosed rental income.

- Levy fines of up to 100% of the outstanding tax, with potential escalation to 200% concerning offshore discrepancies.

- Pursue legal actions where necessary. However, in cases of genuine oversight, HMRC tends to be lenient, limiting their claim to just six years of undeclared income tax.

Common mistakes landlords make

Managing finances as a landlord might seem straightforward, but it is filled with easy-to-make mistakes that can cost dearly. Some common mistakes landlords make are:

- Small or Irregular Expenses: Easily overlooked, but they add up over time. Neglecting these can lead to a loss in potential tax deductions.

- Delayed Record-Keeping: Not updating financial records promptly can create a backlog. The memory alone is an unreliable tool for past transactions.

- Unclaimed Allowable Deductions: Many landlords aren’t aware of all deductible expenses, leading to unnecessary overpayments in taxes.

- Undeclared One-Off Rental Incomes: Forgetting to report occasional incomes can be seen as negligence or evasion by HMRC, even if it was unintentional.

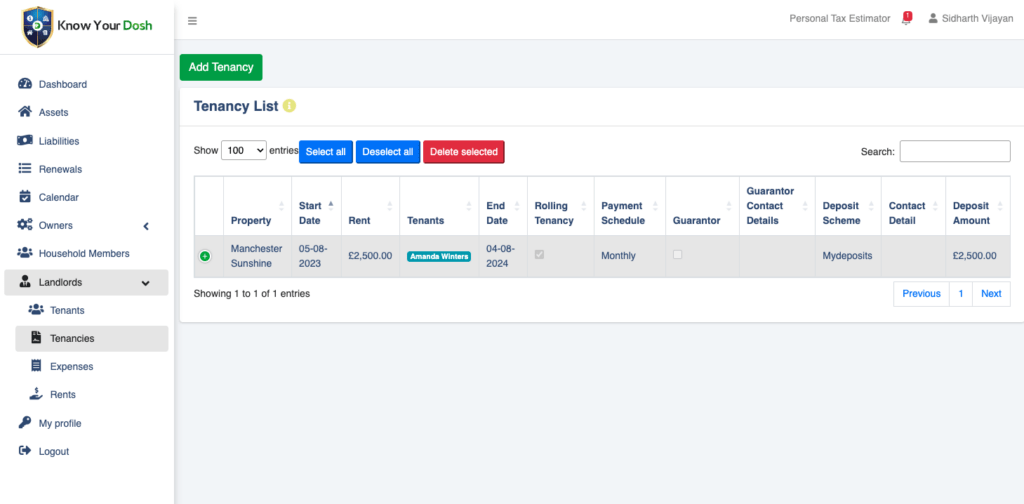

Why Know Your Dosh is your best bet

HMRC is keeping a close eye on landlords, making it super important for you to stay on top of your game. With Know Your Dosh you have nothing to worry about.

Know Your Dosh makes things simpler, helping you keep more of your hard-earned cash, and be set up for success. How is this?

- Efficient Tracking: Never miss a beat. The real-time tracking ensures every penny, whether coming in as rent or going out as a repair expense, is meticulously recorded. Say goodbye to those forgotten transactions or last-minute scrambles to recall an expenditure.

- Comprehensive overview: Information is power. But raw data can be overwhelming. Know Your Dosh doesn’t just collate data; it offers a bird’s-eye view of your financial landscape, presenting insights that empower you to make informed decisions and strategize effectively.

- Efficient tax management: By diligently tracking tenancies, rent payments, and all conceivable expenses, it ensures you are neither overpaying taxes due to overlooked expenses nor underpaying due to undeclared rent. It’s not just about compliance; it’s about optimizing your tax benefits, ensuring you’re financially savvy.

- User-friendly interfaces and reminders: With a user-friendly design, landlords, whether tech-savvy or not, find it a breeze to navigate. The proactive alert system ensures deadlines aren’t missed and all payments – in or out – are on your radar.

Want to simplify your property management processes? Give Know Your Dosh a try!

Disclaimer:

We think you should understand this blog’s strengths and limitations. We’re a financial management platform and aim to provide the best personal finance and lifestyle guidance but can’t guarantee it to be perfect, so please use the information at your discretion.

“Know Your Dosh” can and shall not be held responsible for any outcomes derived from following general guidelines provided as informative blogs.

This info does not constitute financial advice, always research and consult a professional financial advisor before taking any action to ensure it is right for your specific circumstances.

Know Your Dosh blogs often link to other websites, and can’t be held responsible for their content. Always remember anyone can comment on our posts so it can be very different from our opinion.